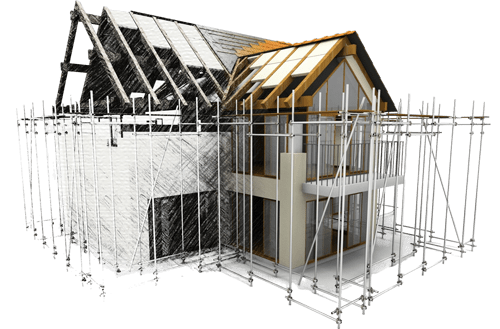

Build your dream home with a tailored construction loan

Interest-only repayments during the build with staged drawdowns that match your progress.

Quick answers. Clear advice. No obligation.

22 years funding experience

Over two decades helping Australian businesses secure funding

Over $1 billion settled

Proven track record of successfully funded business loans

Google 4.9 ★

Highly rated by our clients for service and results

MFAA Member

Accredited by the Mortgage & Finance Association of Australia

A Construction Loan is a means of gaining finance for a commercial or residential development project.

With a Construction Loan, you can get the capital you need to bring your project to fruition.

If you are into property development, Reliiance Financial Solutions can help you arrange finance for a range of projects such as

- Residential unit development

- Residential town houses or villas development

- Residential land sub-division

- Healthcare, hospitality and aged care facilities

- Commercial offices

- Industrial complexes

- Retirement villages

- Retail/shopping centres

Just let us know your project details, and we at Reliiance Financial Solutions will be happy to work with you.

Tailored structures

We design lending strategies that fit your investment goals, tax position, and risk tolerance. Our brokers compare suitable options across a multi-lender panel, explain the trade-offs, and structure your loan so cash flow and flexibility work in your favour.

Faster approvals

You get a dedicated broker and an in-house credit team to fast-track documents, valuations, and lender reviews. We coordinate the moving parts, keep you updated at each step, and aim for conditional approval within tight timelines when the deal demands it.

Ongoing portfolio support

Your investment plan evolves. We review your loans regularly to keep rates competitive, align features like offsets and splits, and help with equity release for the next purchase. You get a steady partner focused on long-term portfolio growth and risk control.

FAQs

Got questions? Find answers to some of the most commonly asked questions about our financial solutions, processes, and services to help you make informed decisions.

After each stage is completed and inspected, your lender releases funds directly to the builder. You are charged interest only on the amount drawn.

No. Stamp duty typically applies to the land purchase. Your builder progress payments are not separately assessed for stamp duty.

Yes, subject to valuation and serviceability. We can structure equity release to cover deposit and costs with safe buffers.

Speak to us early. We can review contingencies, variations, and whether a top-up is possible under policy.

Once documents and contracts are ready, approvals can take one to three weeks depending on lender queues and valuation timing.

Fixed price offers predictability. Cost plus can suit custom builds but requires strong documentation. We will confirm what each lender prefers.

For investment builds, interest may be deductible. Seek advice from a qualified tax professional.

Testimonials

Discover how we’ve helped our clients navigate their financial journeys with personalized solutions. Read their stories of success and empowerment below.

A 5-STAR RATED FINANCIAL SOLUTIONS PROVIDER BY OUR CLIENTS

At Reliiance Financial Solutions, we have been privileged to have worked with hundreds of remarkable individuals and families.

Very few things come close to receiving their genuine appreciation of our services. All we can say in return is – the pleasure was all ours.

It is also our pleasure to share some client testimonials with you. Please click on Video Testimonials to view them all. Use the buttons at the bottom of the screen to navigate through the videos.