The Loan Documents

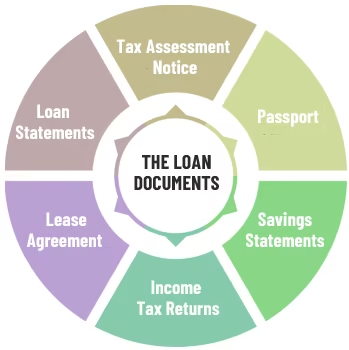

Home loan application involves a fair bit of Information. Generally speaking, all lenders require the same information from you. Certain exceptions may be made for “low doc” home loans for the self- employed. When you come to your loan appointment with your Reliiance Financial Solutions professional, you should bring documents/evidence from the following categories with you (please note there can be variations/additions to this list) :

- Identification

- Property purchases

Identification

You must bring original identification documents with you :

- Driver's licence and passport

PAYE applicants

If you are in regular employment, please bring either :

- two consecutive payslips showing YTD earnings (no older than 4 weeks) OR

- a letter from your employer confirming your salary AND

- your last Group Certificate AND

- your last Tax Assessment Notice

Property purchases

Lenders need to ascertain that you can meet the repayments, so please bring:

- 6 months savings statements AND

- a copy of the Contract for Sale of Land or Offer and Acceptance

Loans and cards

Please bring:

- a copy of recent statement for all credit cards AND

- copies of six months of loan statements for all loans

Self employed

We can also help you with finance if you work for yourself. Bring your:

- latest two years' personal income tax returns and

- latest two years' company tax returns and financials and

- latest Tax Assessment Notice

Refinance

If you want to refinance a loan you already have to take advantage of better loans available now or use the equity in your property for another purpose, bring

- a copy of all loan statements for last 12 months and

- proof of property ownership (e.g. rates notice)

Investors

Your income will be enhanced by the rental you receive. So, bring :

- a letter from real estate agent confirming expected rental OR

- a Copy of current Lease Agreement OR • recent rental statements

Construction loan

If you’re planning to build, lenders will require some extra information. Please bring :

- a copy of your Fixed Price Building Contract and

- a copy of the plans and specifications

FAQs

Got questions? Find answers to some of the most commonly asked questions about our financial solutions, processes, and services to help you make informed decisions.

LMI is a third-party insurance premium payable by you as the borrower, to protect the lender against the potential loss of money if the borrower is unable to repay the home loan. Generally, an application with a Loan-to-Value Ratio (LVR) of 80% or more may result in the borrower having to pay Lender’s Mortgage Insurance.

Extra payment is an excellent feature of a good mortgage deal. Here, your lender lets you make lump-sum additional payments along with your regular monthly payment. Making extra payments allows you to shorten the length of time you are paying your mortgage. Since your balance is being paid off faster, you will also have fewer total payments to make, thus lowering your interest. At Reliiance Financial Solutions, we can help you find the most suitable mortgage deal for you. We have a range of lenders that allow you to make as many extra repayments as you want, whenever you want, without attracting any penalties.

Stamp Duty is a government tax imposed on contracts, with the amount usually calculated as a percentage of the contract value. In layman’s terms, it is the tax charged for your legal documents to be ‘stamped’.

If you are planning to buy a property, it’s crucial to factor your State’s Stamp Duty into your budget.Chances are, based on your circumstances and state of domicile, you might be able to obtain a stamp duty exemption, or concessions (discount) against the purchase of your first home. Stamp duty laws get changed often, so be sure to check your State Government’s website for the most up-to-date information.

Did you know that some lenders would allow you to cash out any extra repayment you made whenever you need the money? You read that right. This useful mortgage feature is called “redraw facility”. You can withdraw any extra repayments or lump sum payments you make over the life of the loan. At Reliiance Financial Solutions, we will explain all mortgage products to you, including those which allow you to the redraw option.

Testimonials

Discover how we’ve helped our clients navigate their financial journeys with personalized solutions. Read their stories of success and empowerment below.

A 5-STAR RATED FINANCIAL SOLUTIONS PROVIDER BY OUR CLIENTS

At Reliiance Financial Solutions, we have been privileged to have worked with hundreds of remarkable individuals and families.

Very few things come close to receiving their genuine appreciation of our services. All we can say in return is – the pleasure was all ours.

It is also our pleasure to share some client testimonials with you. Please click on Video Testimonials to view them all. Use the buttons at the bottom of the screen to navigate through the videos.