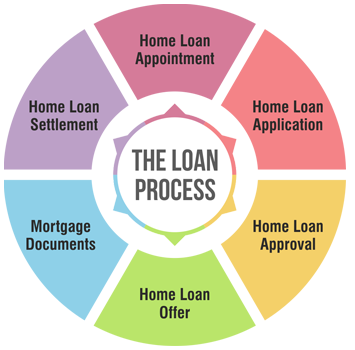

The Loan Process

Especially for first home owners, the entire loan process can be a bit daunting. Reliiance Financial Solutions aims to make the home loan approval process as easy and simple as possible so you know what to expect each step of the way.

- Loan appointment

- Loan application

- Loan approval

- Loan offer

- Mortgage documents

- Loan settlement

Home Loan Appointment

In this meeting we focus on you — your situation, requirements and targets. Based on the information, your Reliiance Financial Solutions professional will go through the range of loan options to choose from. Selecting the right loan is crucial to the entire process of getting a mortgage. Once selected, you will also learn all the details of your chosen loan and complete the loan application form.

Home Loan Application

With the home loan and lender selected, now it is time to apply for the loan. Your Reliiance Financial Solutions professional will package your home loan application with the supporting documents, keeping you involved right through, and then lodge it with your chosen lender. On the other side, the lender will get into action. Their process involves – assessing your application, asking for more information if required, performing credit checks and, if necessary, arrange a valuation of your property and organise mortgage insurance if required.

Home Loan Approval

If all the documents are in order and all checks are valid, it is generally time for the good news.

At this stage, the lender will advise your Reliiance Financial Solutions professional that your loan has been unconditionally approved. Once we confirm the news, we notify you immediately. At this stage you may also need to organise your building insurance, which will be needed for settlement.

Home Loan Offer

It is time for signing of contracts. Your lender will send you a loan offer for you to sign and return. The home loan offer is your loan contract and outlines the terms and conditions of the home loan, including the interest rate, term and the range of possible fees. If you have any questions about any of the documents, this is the right stage so please don’t hesitate to ask your Reliiance Financial Solutions professional. At this stage, you may need to hire the services of a conveyancer.

Mortgage Documents

Your lender will send you or your conveyancer your mortgage documents to be signed and returned. These documents include the lender’s standard terms and conditions as well as the legal document giving the lender security over the property.

Home Loan Settlement

Once you have selected the property you wish to purchase and all things are in order on that front, your lender will liaise with your conveyancer to arrange for settlement of the loan. The home loan will be ‘drawn down’ and the property will transfer into your ownership.

Time to celebrate!

Remember, you can always contact your Reliiance Financial Solutions

professional for more information.

FAQs

Got questions? Find answers to some of the most commonly asked questions about our financial solutions, processes, and services to help you make informed decisions.

LMI is a third-party insurance premium payable by you as the borrower, to protect the lender against the potential loss of money if the borrower is unable to repay the home loan. Generally, an application with a Loan-to-Value Ratio (LVR) of 80% or more may result in the borrower having to pay Lender’s Mortgage Insurance.

Extra payment is an excellent feature of a good mortgage deal. Here, your lender lets you make lump-sum additional payments along with your regular monthly payment. Making extra payments allows you to shorten the length of time you are paying your mortgage. Since your balance is being paid off faster, you will also have fewer total payments to make, thus lowering your interest. At Reliiance Financial Solutions, we can help you find the most suitable mortgage deal for you. We have a range of lenders that allow you to make as many extra repayments as you want, whenever you want, without attracting any penalties.

Stamp Duty is a government tax imposed on contracts, with the amount usually calculated as a percentage of the contract value. In layman’s terms, it is the tax charged for your legal documents to be ‘stamped’.

If you are planning to buy a property, it’s crucial to factor your State’s Stamp Duty into your budget.Chances are, based on your circumstances and state of domicile, you might be able to obtain a stamp duty exemption, or concessions (discount) against the purchase of your first home. Stamp duty laws get changed often, so be sure to check your State Government’s website for the most up-to-date information.

Did you know that some lenders would allow you to cash out any extra repayment you made whenever you need the money? You read that right. This useful mortgage feature is called “redraw facility”. You can withdraw any extra repayments or lump sum payments you make over the life of the loan. At Reliiance Financial Solutions, we will explain all mortgage products to you, including those which allow you to the redraw option.

Testimonials

Discover how we’ve helped our clients navigate their financial journeys with personalized solutions. Read their stories of success and empowerment below.

A 5-STAR RATED FINANCIAL SOLUTIONS PROVIDER BY OUR CLIENTS

At Reliiance Financial Solutions, we have been privileged to have worked with hundreds of remarkable individuals and families.

Very few things come close to receiving their genuine appreciation of our services. All we can say in return is – the pleasure was all ours.

It is also our pleasure to share some client testimonials with you. Please click on Video Testimonials to view them all. Use the buttons at the bottom of the screen to navigate through the videos.